Tempus AITEM: Revolutionizing Healthcare with Artificial Intelligence

Introduction

In the rapidly evolving landscape of healthcare technology, Tempus AITEM is emerging as a leading innovator in artificial intelligence-based solutions. The company’s impressive growth over the past six months has piqued investors’ interest, and its financial performance has been nothing short of remarkable. This article will delve into the factors contributing to Tempus AI’s success, including its robust Q3 performance, compelling acquisition strategies, and improving EBITDA track record.

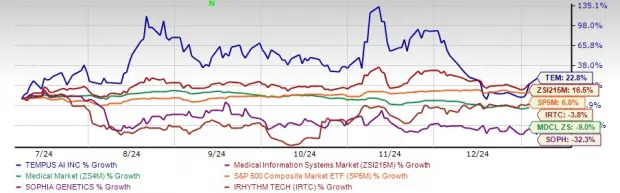

Outperforming the Industry

Since its successful IPO in June 2024, Tempus AITEM’s stock has demonstrated a significant rally of 22.8% over the past six months, outperforming the Medical Info Systems industry (16.5%) and the benchmark (6.8%). Moreover, the company’s growth far surpasses that of other health infotech players like iRhythm Technologies (IRTC) (-3.8%) and SOPHiA GENETICS (SOPH) (-32.3%).

Six-Month Share Comparison

| Company | 6-Month Price Change |

| — | — |

| Tempus AI (TEM) | 22.8% |

| iRhythm Technologies (IRTC) | -3.8% |

| SOPHiA GENETICS (SOPH) | -32.3% |

The Market’s Appetite for AI in Healthcare

The market’s enthusiasm for AI applications in healthcare is on the rise, with Tempus AI at the forefront of this high-growth sector. Analysts attribute the company’s success to its cutting-edge product lines and strategic plans, positioning it for long-term success.

Key Differentiators

- Cutting-Edge Product Lines: Tempus AI’s innovative products are designed to enhance clinical and scientific innovation in healthcare.

- Strategic Plans: The company’s strategic approach enables it to capitalize on expanding opportunities in the AI market.

Robust Q3 Performance

In the third quarter of 2024, Tempus AI reported impressive growth across various segments. Notably, its Genomics unit accelerated by 23.9% year over year, driven by increased demand for data licensing services.

Q3 Highlights

- Genomics Unit Growth: 23.9% YoY

- Data and Services Revenues: 64.4% YoY

- Insights Data Licensing Business: 86.6% YoY

Compelling Acquisition Strategy

Tempus AI’s acquisition of Ambry Genetics is expected to generate significant revenue growth, with the latter projected to contribute over $300 million in revenues in calendar year 2024.

Ambry Genetics Acquisition

- Purchase Price: $600 million (cash and shares)

- Projected Revenue Growth: Over $300 million in 2024

Improving EBITDA Track Record

Tempus AI’s adjusted EBITDA of -$23.8 million represents a significant improvement from its previous quarter, reflecting the company’s efforts to enhance profitability.

EBITDA Highlights

- Q3 Adjusted EBITDA: -$23.8 million

- YoY Improvement: 25.6%

Valuation and Outlook

Although Tempus AI’s valuation is slightly higher than its industry peers, upward revisions in earnings estimates reinforce the company’s Zacks Rank #2 (Buy).

Valuation Comparison

| Company | Forward P/S Ratio |

| — | — |

| Tempus AI (TEM) | 7.09X |

| iRhythm Technologies (IRTC) | 4.24X |

| SOPHiA GENETICS (SOPH) | 2.48X |

Conclusion

Tempus AITEM’s impressive growth, compelling acquisition strategy, and improving EBITDA track record make it an attractive investment opportunity in the AI and healthcare sectors. With a strong financial outlook and efforts to enhance healthcare outcomes, TEM presents a unique chance for investors seeking high returns.

Investor Takeaway

- Strong Financial Outlook: Tempus AI’s robust Q3 performance and improving EBITDA track record demonstrate its potential for long-term success.

- Enhancing Healthcare Outcomes: The company’s innovative products are designed to enhance clinical and scientific innovation in healthcare, making it an attractive investment opportunity.