With Intuit discontinuing its personal finance app Mint in January, some startups are already seeing a boost in new customers. One of these is Monarch Money, a subscription-based money manager app co-founded by Val Agostino, Jon Sutherland, and Ozzie Osman. The app aims to help users create financial goals and provide a path to achieve them.

A Brief History of Mint

Monarch’s CEO, Val Agostino, has a personal connection to Mint. He was the first product manager on the original team that built Mint and headed up the product team through Intuit’s acquisition in 2010. In his blog post following Intuit’s news, Agostino noted that Credit Karma, which Intuit purchased in 2020, has an estimated user base of 130 million U.S. users, larger than Mint’s 3.6 million monthly active users reported in 2021.

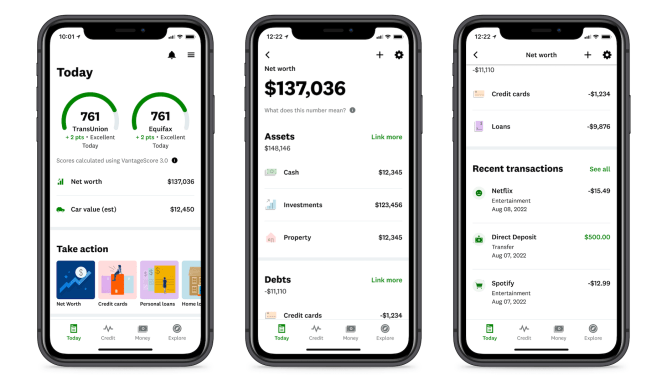

Monarch Money: The Alternative to Mint

When asked about the impact of Mint’s discontinuation on Monarch, Osman stated that since the news broke, they’re getting twice the number of new users, and it’s all coming from this. According to their Google Play store page, Monarch has over 10,000 downloads lifetime. However, Osman declined to provide more specific numbers.

Monarch provides the ability to import Mint data, allowing users to try out Monarch while preserving their financial history. Agostino noted in his blog post that "if you’re Intuit, it doesn’t make sense to keep investing in both of these consumer platforms, so I’m not surprised they’re shutting Mint down and consolidating on Credit Karma."

Why Monarch is a Viable Alternative

Agostino highlighted the differences between Monarch and Mint. He stated that "the business model of a free personal finance app is simply not viable due to the high costs required for financial data aggregation." Moreover, users sign up for these apps with the hopes of improving their financial lives. When an app is ad-supported, the needs of advertisers are prioritized over those of the users, ultimately defeating the purpose.

The Competition: Cheddar and Wesabe

Shawn Adrian, co-founder of spend tracking app Cheddar, tweeted that he had previously worked at a personal finance startup called Wesabe in 2008. He stated that "it was actually hard to compete with Mint." TechCrunch spoke to Wesabe’s co-founder Marc Hedlund about this topic in 2010.

Adrian said via direct message that "Intuit must be absolutely banking cash to view our largest competitor, Mint, as a languishing side project. That said, we’ve seen a bump in new customers since Mint’s discontinuation."

Conclusion

With Mint’s discontinuation, startups like Monarch Money are seeing an opportunity to grow their user base. Monarch’s unique approach and focus on providing a viable business model make it an attractive alternative to Mint. As the fintech industry continues to evolve, it will be interesting to see how these startups adapt and compete in the market.